Curious How AI Can Simplify Finance? Explore Compliance, Risk, and Seamless Integrations

The financial world has always been complex—rules change constantly, risks evolve overnight, and businesses must move faster than ever. In this environment, Artificial Intelligence (AI) has become a game-changer. By combining data-driven insights with automation, AI-powered solutions are helping financial institutions and businesses achieve greater efficiency, compliance, and accuracy.

Let’s explore how these technologies are transforming industries and making day-to-day operations smarter, safer, and more reliable.

Automated Compliance Checks: Staying Ahead of Regulations

One of the toughest challenges for any financial or business organization is regulatory compliance. Governments and industry bodies introduce new laws, frameworks, and standards at a rapid pace. Staying compliant is not just about following rules—it’s about protecting a company’s reputation and avoiding costly penalties.

Traditionally, compliance checks required endless paperwork, manual audits, and hours of human oversight. With AI, this entire process becomes faster and more accurate. Automated compliance checks can:

-

Monitor transactions in real time

-

Flag suspicious activity instantly

-

Cross-check data against constantly updated regulatory databases

-

Ensure 99.9% adherence to compliance standards

This level of automation minimizes human error and allows businesses to focus on strategic decision-making instead of drowning in paperwork. For example, banks and insurance companies can now validate customer records, assess risk, and meet “Know Your Customer” (KYC) or “Anti-Money Laundering” (AML) requirements without manual delays.

In industries where the cost of non-compliance can reach millions, automated systems act as a safety net, ensuring organizations always stay a step ahead.

Predictive Risk Assessment: Making Smarter Financial Decisions

Managing financial portfolios involves both opportunity and risk. Markets fluctuate, customer behaviors shift, and global events often cause unexpected impacts. Predictive risk assessment, powered by AI, is helping organizations foresee potential challenges before they happen.

Using machine learning models, these systems analyze vast amounts of historical and real-time data to identify patterns that humans might miss. They can:

-

Predict credit risks for individual borrowers or companies

-

Highlight vulnerabilities in investment portfolios

-

Forecast potential fraud or default scenarios

-

Provide early warnings about market volatility

For businesses, this means fewer surprises and more informed decisions. Instead of reacting to problems after they occur, organizations can proactively adjust their strategies. Investors, for example, gain a deeper understanding of portfolio risks, while lenders reduce exposure to high-risk borrowers.

In today’s fast-moving economy, predictive risk assessment offers a competitive edge by allowing organizations to take calculated steps rather than relying on guesswork.

API-First Architecture: Seamless Integrations for the Future

Technology no longer works in isolation—every tool needs to connect smoothly with others. That’s where API-first architecture comes into play. By designing financial and business solutions with Application Programming Interfaces (APIs) at the core, organizations can integrate AI-powered services seamlessly into their existing systems.

Here’s why this matters:

-

Flexibility: Businesses can plug AI-driven compliance or risk assessment modules directly into their current workflows without massive overhauls.

-

Scalability: As organizations grow, APIs allow easy expansion and connectivity with new platforms.

-

Speed: New applications or services can be deployed faster, reducing time-to-market.

-

Innovation: Developers gain the freedom to build custom solutions on top of a reliable AI backbone.

For example, a bank could integrate AI-driven fraud detection into its mobile app without disrupting customer experience. Or an insurance provider could connect predictive analytics to its claims processing system for faster decision-making.

API-first design ensures that AI doesn’t remain a stand-alone tool but becomes a natural extension of every business process.

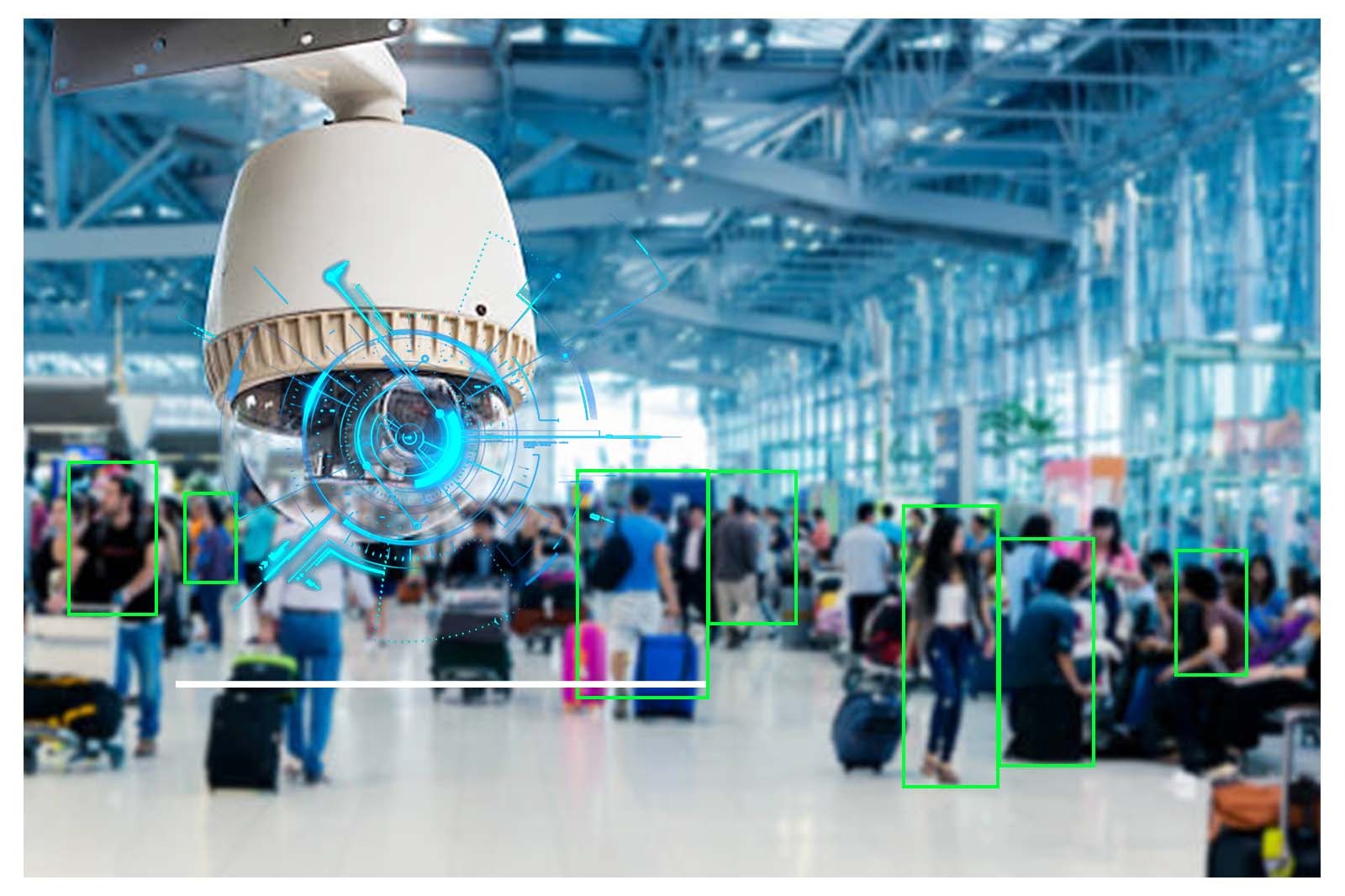

Video Analytics for Workplace Safety: What It Is and Why Your Business Needs It?

How Businesses Identify the Best Image Processing Company in India for Long-Term Success?

How to Identify the Best Video Analytics Company in India for AI-Driven Surveillance?

Best Video Analytics Company in India: A Complete Buyer’s Guide for Enterprises

AI in Predictive Analytics: How Businesses Can Prepare for the Future Today?

Why AI-Powered Video Analytics Is Becoming Essential for Modern Enterprises?

How AI and Data Analytics Are Helping Businesses Make Smarter Decisions?

Why Traditional CCTV Fails in Real-Time Threat Detection?

Video Analytics vs AI Surveillance – What Most Businesses Get Wrong?

Best Computer Vision Company in India for Businesses of All Sizes

Choosing the Best Video Analytics Company in India: Key Points to Check

From Watching to Protecting: How Video Analytics Ensures Workplace Safety?

Beyond Human Eyes: How Computer Vision is Transforming the Next Generation of Workplace Safety?

When Cameras Start Thinking: How AI Is Transforming Modern Surveillance?

Can Predictive Analytics Really Help Your Business Grow?

From Cameras to Clarity: How Enterprises Turn Raw Footage into Real-Time Business Intelligence?

Why Edge + AI Is the Future: Real-Time Intelligence for a Smarter, Safer Enterprise?

Smart Solutions Behind Mega Infrastructure: Making Complexity Look Easy

Is Your Workplace Really Safe? Discover How Smart Surveillance is Changing Safety Standards

How AI Video Analytics is Transforming Large Infrastructure, Ports, Airports, and Smart Cities?

Retail Revolution: How AI Powered Video Analytics Can Drive Success

Leveraging AI in Manufacturing for enhanced Safety, Efficiency and Innovation